Credit Cards

Cash back, travel rewards and more

With our Flex Rewards program, earn rewards points that can be redeemed for cash back, travel, merchandise, event tickets and gift cards.

Rewards are waiting with a card that fits your lifestyle. With the Cash Back Visa Infinite card, you have perks that fit the way you live your life - from purchase protection, to coverage for your mobile device, to those days you want to live it up a little with your Visa Infinite Exclusive Benefits.

Collect points twice as fast with our premium rewards card. Includes comprehensive travel insurance.

It doesn't matter if you're buying groceries or dining out with friends. It all adds up to valuable cash back.

The best of both worlds. A rewards card with a low annual fee and a low interest rate. Mobile device insurance and purchase protection too.

More Details

Looking for a lower fee? Sometimes carry a balance? Our low fee/low interest cards may be ideal.

The Classic Mastercard keeps everything easy: a low annual fee, a low interest rate, and basic purchase protection.

Studying at a post secondary institution? Having a student credit card is not only convenient, it helps you build your credit history.

For the frequent US traveller or those that regularly purchase from US online retailers. Includes travel insurance and rewards.

24/7 Cardholder support

Zero liability fraud protection

Purchase protection

Mobile device protection

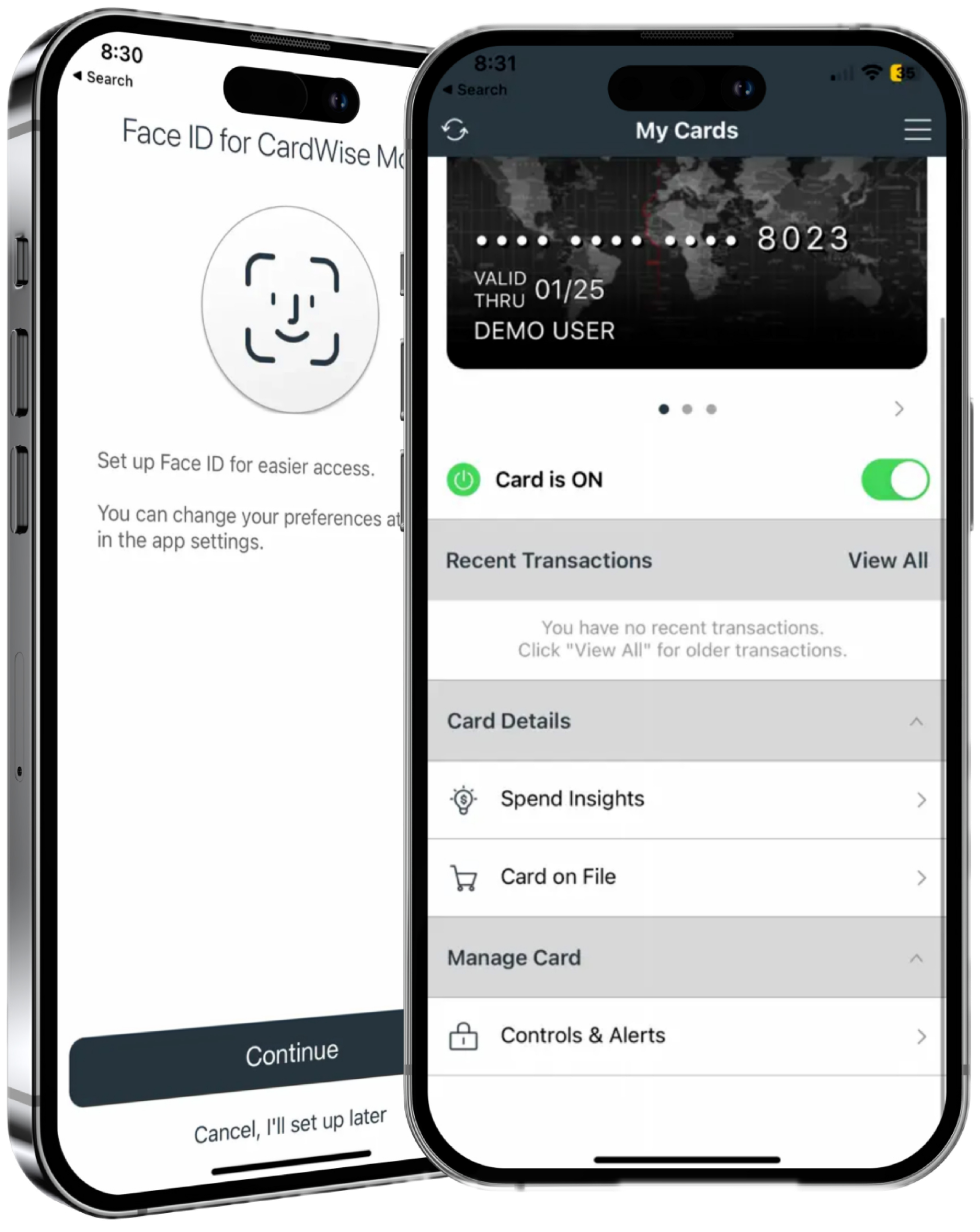

Activate your card, track your spending, set up alerts, lock your card and more

![]()

Email Us

We’ll reply within same business day (if possible), or the next business day.

![]()

Book an Appointment

We’ll reply within same business day (if possible), or the next business day.