Mobile Wallet

Digital Banking Services

Digital Banking Services

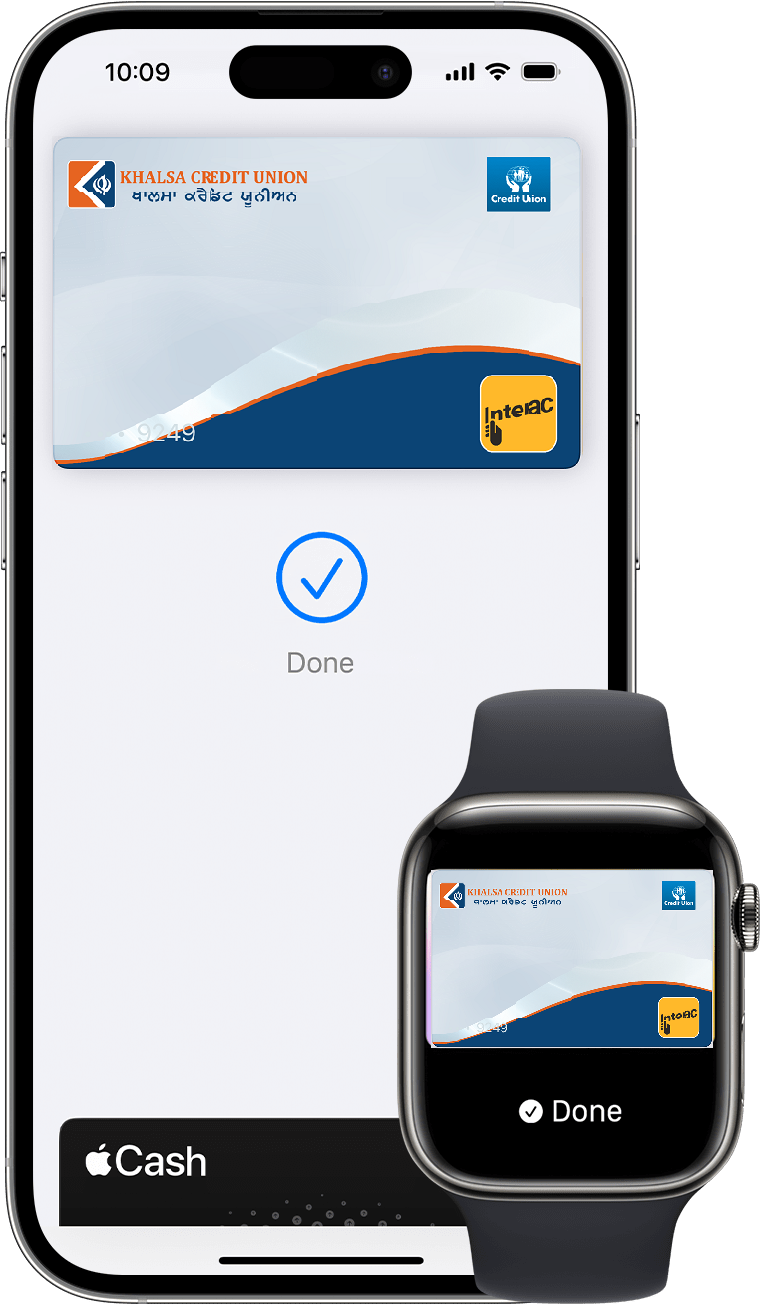

On your iPhone

1. Open the Wallet app.

2. Tap the (+) sign in the upper right corner.

3. Follow the on-screen instructions to add your WFCU Debit Mastercard.

On your Apple Watch

1. Open the Apple Watch app on your iPhone.

2. Go to the My Watch tab. If you have multiple watches, choose one.

3. Tap Wallet & Apple Pay and select Add Debit Card.

4. Follow the onscreen instructions to add your WFCU Debit Mastercard.

Paying with Apple Pay

On an iPhone 8 or earlier with Touch ID:

1. Rest your finger or thumb on the home button and hold the top of your iPhone within a few centimetres of the contactless reader.

2. You will see Done and a checkmark on the display letting you know your payment was approved. If vibration and sounds are enabled, you will feel a subtle vibration and hear a beep.

On an iPhone X or higher versions:

1. Double-click the side button.

2. Glance at iPhone X to authenticate with Face ID or enter your passcode.

3. Hold the top of iPhone X within a few centimeters of the contactless reader until you see Done and a checkmark on the display.

On an Apple Watch:

1. Double-click the side button and hold the display of your Apple Watch within a few centimetres of the contactless reader.

2. Wait until you feel a gentle tap.

3. You will see Done and a checkmark on the display letting you know your payment was approved.

Where to Use Apple Pay

Using your KCU Debit Card on Apple Pay works wherever lnterac® Flash is accepted. Just look for the lnterac logo or contactless symbol at the checkout. Some stores will also display the Apple Pay logo.

On your smartphone

1. Download Google Wallet from the Google Play Store.

2. Open the Google Wallet app.

3. Tap the(+) sign.

4. Follow the on-screen instructions to add your KCU Debit Card.

On your wearable

1. Open Google Wallet on the watch.

2. Tap(+) to Add Card and choose your KCU Debit Card.

3. Follow the on-screen prompts to complete setup.

Paying with Google Pay

On your smartphone:

1. Unlock your phone.

2. Hold your phone over the terminal until you see a blue check mark on the screen.

On your wearable:

1. On your watch, open the Google Wallet app.

2. Hold your watch over the contactless payment terminal until you hear a sound or feel vibration from your watch.

Where to Use Google Pay

Using your KCU Debit Card on Google Pay works wherever lnterac® Flash is accepted. Just look for the lnterac logo or contactless symbol at the checkout. Some stores will also display the Google Pay logo.

Google Pay and Google Wallet are trademarks of Google LLC

On your mobile device

1. Open your Samsung Wallet.

2. Tap the(+) sign in the upper right corner.

3. Follow the on-screen instructions to add your KCU Debit Card.

Paying with Samsung Pay

On your mobile device:

1. Open your Samsung Wallet.

2. Select your KCU Debit Card.

3. Authenticate your card with PIN, fingerprint, or iris scan.

4. Hold your phone to the payment terminal. A subtle vibration and beep will confirm your payment and the screen will show a checkmark with a "Payment completed" message. The payment terminal will also let you know when the payment is approved.

Where to Use Samsung Pay

Using your KCU Debit Card on Samsung Pay works wherever lnterac® Flash is accepted. Just look for the lnterac logo or contactless symbol at the checkout. Some stores will also display the Samsung Pay logo.

These Terms of Use ("Terms") govern your use of any eligible Credit Union debit card ("Card") when you add or keep your Card in a mobile wallet ("Wallet") for use on any eligible device ("Device") that supports the use of the Wallet.

Please read these Terms carefully. If you add or activate your Card for use in a Wallet, it means that you accept and agree to these Terms. In these Terms, "you" and "your" means each Credit Union member who has been issued a Credit Union Card. "We", "us", and "our" mean Credit Union.

These Terms are in addition to, and supplement, all other agreements between Credit Union and Member regarding Credit Union's products and services. If there is any conflict or inconsistency between these Terms and the other agreements, then these Terms will take priority and govern with respect to the Wallet service.

You understand that your use of the Wallet will also be subject to agreements or terms of use with the relevant Wallet Provider ("Wallet Provider") and other third parties (such as your wireless carrier and the websites and services of other third parties integrated with the Wallet).

If you want to add a Card to a Wallet, you must follow the procedures adopted by the Wallet provider, any instructions provided by us, and any further procedures the Wallet provider or we adopt. You understand that we may not add a Card to a Wallet if we cannot verify the Card, if your account is not in good standing, if we suspect that there may be fraud associated with your Card or for any other reason we determine at our sole discretion. The Wallet allows you to make purchases using your Card wherever that Wallet is accepted. Wallets may not be accepted at all places where your Card is accepted.

We may not permit the addition of a Card to a Wallet, or we may remove, suspend or cancel your access to a Wallet at any time, if we cannot verify the Card, if we suspect that there may be fraud associated with the use of the Card, if your account is not in good standing, if applicable laws change, or for any other reason we determine at our sole discretion.

You may suspend, delete or reactivate a Card from a Wallet by following the Wallet Provider's procedures for suspension, deletion or reactivation. In certain circumstances, your Card may be suspended or removed from the Wallet by the Wallet Provider.

Payment networks, merchants or we may establish transaction limits from time to time in their or our discretion. As a result, you may be unable to use a Wallet to complete a transaction that exceeds these limits.

We do not charge you any fees for adding a Card to the Wallet. Please consult your Card agreement for any applicable fees or other charges associated with your Card.

Your mobile service carrier or provider, Wallet Provider or other third parties may charge you service fees in connection with your use of your Device or the Wallet.

You must contact us immediately if your Card is lost or stolen, if your Device is lost or stolen, or if your Card account is compromised. If you get a new Device, you must delete all your Card and other personal information from your prior Device.

You are required to contact us immediately if there are errors or if you suspect fraud with your Card. We will resolve any potential error or fraudulent purchase in accordance with the applicable account agreement.

You agree to protect and keep confidential your Wallet Provider ID and passwords. If you share these credentials with others, they may be able to access a Wallet and make purchases with your Card or obtain your personal information.

Before using a Wallet, you should ensure that only your credentials are registered on your Device as these will then be considered authorized to make transactions related to your Card. If the credentials of another person are used to unlock your Device or make transactions, these transactions will be deemed to be authorized by you.

You are prohibited from using a Wallet on a Device that you know or have reason to believe has had its security or integrity compromised (e.g. where the Device has been "rooted" or had its security mechanisms bypassed).

The Wallet Provider is responsible for the security of information provided to them or stored in the Wallet.

You are solely responsible for all account transactions made using your Card processed through a Wallet. You are responsible for the completeness and accuracy of the account information you enter into the Wallet. Only the individual member whose name is associated with the Card should add the Card to a Wallet.

You consent to the collection, use and disclosure of your personal information from time to time as provided in our privacy policy, which is available on our website. We may share with or receive from the Wallet Provider such information as may reasonably be necessary to determine your eligibility for, enrollment in and use of a Wallet or its features you may select (for example, your name and details such as Card number and expiry date).

The Wallet Provider may aggregate your information or make it anonymous for the purposes set out in its privacy policy or terms of use. To help protect you and us from error and criminal activities, we and The Wallet Provider may share information reasonably required for such purposes as fraud detection and prevention (for example, informing the Wallet Provider if you notify us of a lost or stolen Device).

You agree to receive communications from us, including emails to the email address or text message to the mobile number you have provided in connection with your Card account. These communications will relate to your use of your Card(s) in the Wallet. You agree to update your contact information when it changes by contacting us. You may also contact us if you wish to withdraw your consent to receive these communications but doing so may result in your inability to continue to use your Card(s) in the Wallet.

For the purpose of this Section, "Credit Union" means Credit Union and its agents, contractors, and service providers, and each of their respective subsidiaries. The provisions set out in this section shall survive termination of these Terms.

The Wallet service is provided by the Wallet Provider, and Credit Union is not responsible for its use or function. You acknowledge and agree that Credit Union makes no representations, warranties or conditions relating to the Wallet of any kind, and in particular, Credit Union does not warrant: (a) the operability or functionality of the Wallet or that the Wallet will be available to complete a transaction; (b) that any particular merchant will be a participating merchant at which payments with the Wallet are available; (c) that the Wallet will meet your requirements or that the operation of the Wallet will be uninterrupted or error-free; and (d) the availability or operability of the wireless networks of any Device.

Credit Union will have no liability whatever in relation to the Wallet, including without limitation in relation to the sale, distribution or use thereof, or the performance or non-performance of the Wallet, or any loss, injury or inconvenience you suffer. You may want to consider keeping your physical Card with you to use in the event you cannot make Wallet transactions.

We may change these Terms, or the agreements associated with the use of your Card with the Wallet. You agree to any changes to these Terms or agreement(s) associated with the use of your Card or account by your continued use of your Card with the Wallet. If you do not accept the revised Terms or agreement(s), you must delete your Card from the Wallet.

You may contact us about anything concerning your Card or these Terms by calling the phone number found on our website.

If you have any questions or complaints about the Wallet, or disputes with the Wallet Provider, you should contact the Wallet provider.

![]()

Email Us

We’ll reply within same business day (if possible), or the next business day.

![]()

Book an Appointment

We’ll reply within same business day (if possible), or the next business day.